Risk Management and Position Sizing System EA

Risk Management and Position Sizing System EA

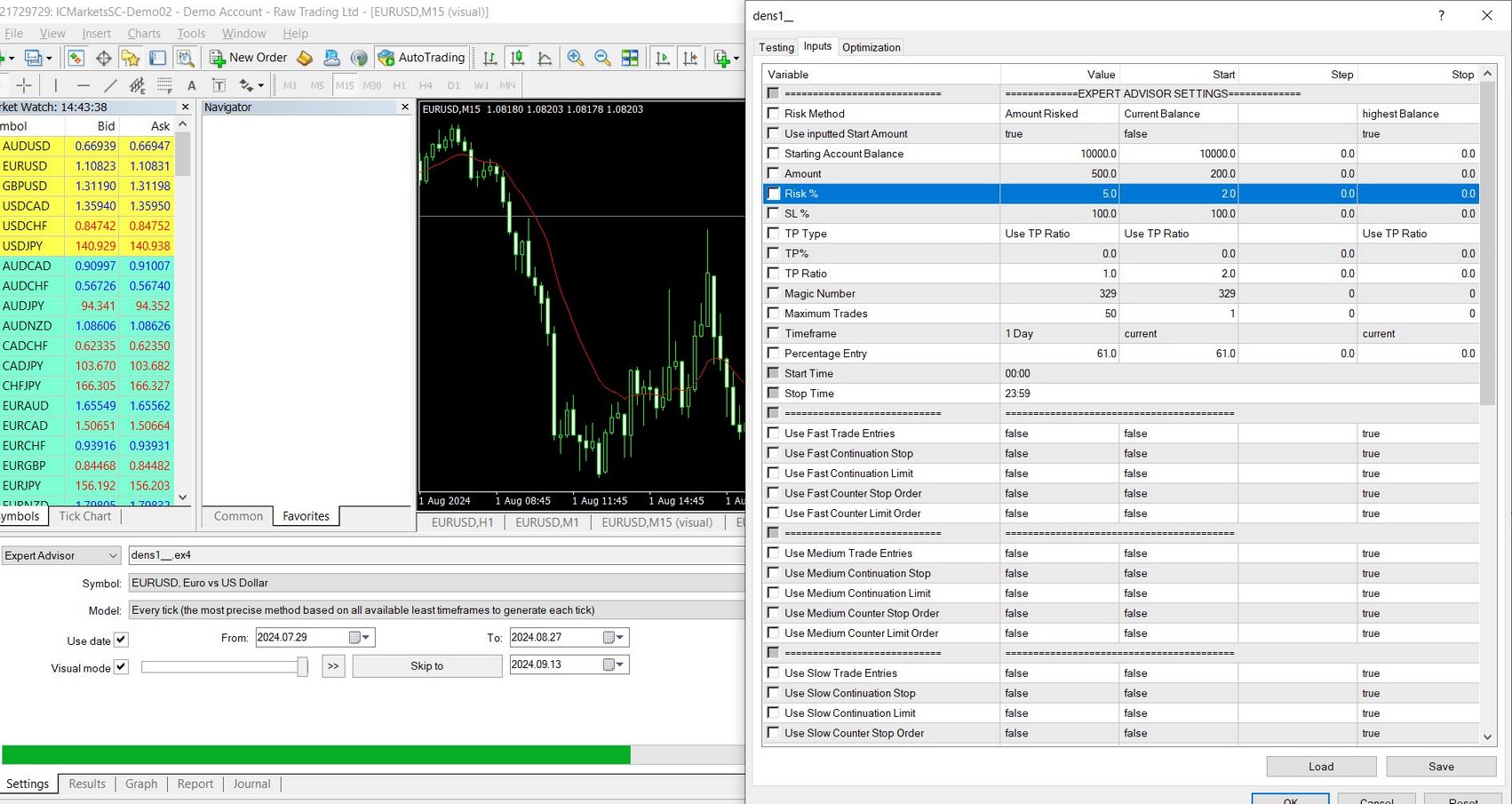

Objective: A trader needed a robust risk management system that could automatically adjust position sizes and set stop-loss/take-profit levels based on market conditions and predefined risk parameters

Solution: Created an EA that dynamically calculates and adjusts position sizes according to account equity, volatility, and risk tolerance. It also includes customizable risk management rules such as trailing stops, breakeven points, and maximum drawdown limits.

Results: The EA significantly reduced the client’s drawdowns and optimized their overall risk exposure, resulting in more consistent trading results.